- Heavy Metal Money

- Posts

- The $100K Dream Just Got a Serious Reality Check

The $100K Dream Just Got a Serious Reality Check

When Six Figures Stopped Being Enough?

3 Tricks Billionaires Use to Help Protect Wealth Through Shaky Markets

“If I hear bad news about the stock market one more time, I’m gonna be sick.”

We get it. Investors are rattled, costs keep rising, and the world keeps getting weirder.

So, who’s better at handling their money than the uber-rich?

Have 3 long-term investing tips UBS (Swiss bank) shared for shaky times:

Hold extra cash for expenses and buying cheap if markets fall.

Diversify outside stocks (Gold, real estate, etc.).

Hold a slice of wealth in alternatives that tend not to move with equities.

The catch? Most alternatives aren’t open to everyday investors

That’s why Masterworks exists: 70,000+ members invest in shares of something that’s appreciated more overall than the S&P 500 over 30 years without moving in lockstep with it.*

Contemporary and post war art by legends like Banksy, Basquiat, and more.

Sounds crazy, but it’s real. One way to help reclaim control this week:

*Past performance is not indicative of future returns. Investing involves risk. Reg A disclosures: masterworks.com/cd

Isn’t $100k Enough?!

I remember when landing a six-figure salary felt like something pretend, or thinking nobody actually makes this kind of money. I then remember thinking if you were fortunate enough get finally claw your way up to making a $100k per year it would be like you’d finally hit that sweet spot where money stress would just… disappear? Right?! Yeah, well I guess those days are gone, and they’re not coming back.

Here’s the brutal truth (not the Grindcore band out of New York) what used to be what I would have called the gold standard of “making it” now feels more like you’d be just scraping by in a lot of places across the country! It’s kinda hard to believe. The goal posts didn’t just move a little further away. They got loaded onto a truck and driven to another state entirely!

Americans now consider, get this, $270,000 to be the benchmark for success! What in the actual F! Not $100,000. Two hundred and seventy thousand dollars. That’s not a typo. That’s the new bar, and it’s a hell of a lot higher than where most of us are standing. Or, would ever hope to be standing.

So let’s talk about what’s really going on with today’s salaries, the expectations, and the gap between what we think we should be making and what is clash with reality (insert ripping Pantera track here) actually delivers. Because if you’re, like, a new grad stepping into this messy job market, or even a mid-career professional wondering why your paycheck doesn’t stretch like it used to, you need to understand the game (I love this song by Disturbed) that’s being played.

Why Your Parents’ Salary Advice Is Basically Useless Now

Your parents probably told you that if you work hard, get good grades, and land a decent job, you’ll be fine. Maybe they even threw out that magic number: $100,000. “Get to six figures and you’re set!” Except that advice is about as useful as a cassette tape player in 2026. It’s true! I still have some cassettes, but no way to play them!

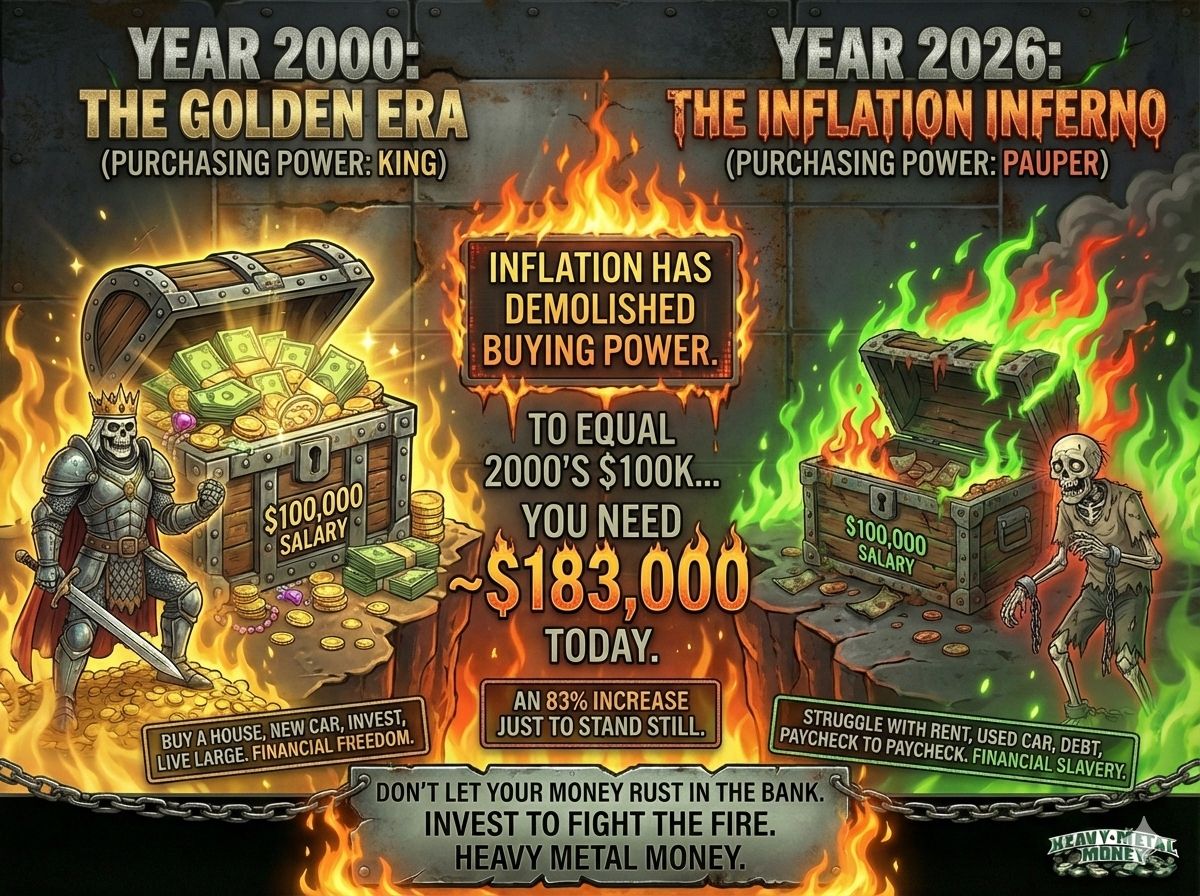

Here’s a reason this is happening. So, inflation has absolutely demolished the buying power of that old $100K salary. To have the same purchasing power that $100,000 had back in 2000, you’d need to be making around $183,000 today. That’s an 83% increase just to stand still financially.

Inflation has demolished the buying power of that old $100K salary.

Expectations for New Grads

So you’ve got your degree in hand, maybe some student debt on your back, and you’re ready to start rockin’ your career. What should you expect?

Well, here’s where things get messy. New college grads are walking into the job market they THINK the average starting salaries will be around $101,500. That seems kinda awesome, right? I mean, when I finished school, my first job as like $32k! Anyway, when you consider student debt, cost of living, and all the “invest in yourself through education” messaging we’ve been fed for years.

Other Stories

Thanks again for following along! Keep those Horns Up, my friend 🤘 🤘 And please share this newsletter with those you think would find value!