- Heavy Metal Money

- Posts

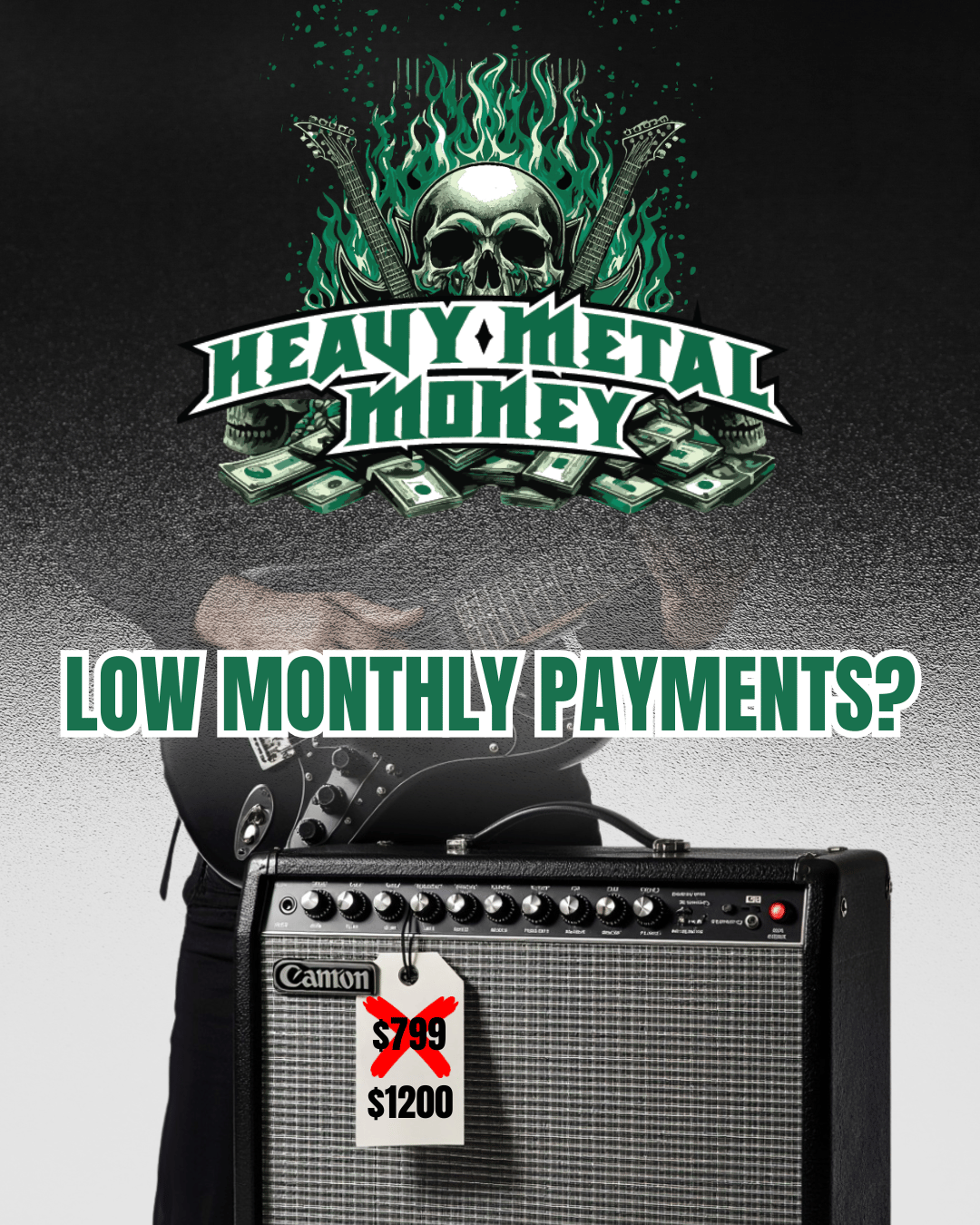

- What “Low Monthly Payments” Really Cost You

What “Low Monthly Payments” Really Cost You

If the purchase doesn’t fit without financing, you probably can’t afford it.

Back in the day, I thought I was just living a “normal” life. You know, working the day job that was kinda boring, while chasing the rock ‘n’ roll dream. I had a typical anxiety inducing relationship with money. Ya know, most of us feel but rarely talk about. I never had enough. I always wanted more. And, of course, none of that was “my” fault… right? Let’s take a look at what “low monthly payments” really cost you.

If only I had more money, all my problems would vanish. At least, that’s what I told myself. Money would solve all my problems.

I’d already had my first run-in with a department store credit card and the emotional roller coaster of revolving debt. But nothing prepared me for the financial faceplant that came with my first taste of real consumer financing.

Dreams, Delusions, and Distortion

Let me set the scene: I was in my early twenties, broke but bold, still convinced I was destined to play guitar on stages around the world. I didn’t have a plan. I didn’t have skill or talent. Hell, I barely knew enough riffs to fill a setlist. But I had the dream. Anyway, that dream kept dragging me into local music stores like a moth to a flame.

Every week or so my friends and I would hang out at music and guitar shops, pretending we were auditioning gear for our next world tour. We’d crank out Metallica’s “Seek & Destroy,” “Jump in the Fire” or their cover of Diamond Head’s “Am I Evil” like we owned the place. Well, then one fateful day, I plugged into a combo amp that made my beginner-level thrashing sound killer. The gain, the reverb, the chorus—this thing didn’t just amplify my sound, it amplified my ego haha!

Then Came The Pitch

“You can finance it—and take it home today,” the salesman said, like some kind of dark wizard summoning temptation. “It’s just $23 a month!”

Wait… what?

For a guy making less than $8 an hour, living in my first house I somehow managed to buy at age 20, this felt like a VIP path to greatness. Twenty-three bucks a month? I didn’t have much money, but I should be able to swing only $23 per month! This smooth-talking salesdude asked for my license, my Social Security number. He said he’d be right back and spent few minutes on the phone. He returned and asked for a couple quick signatures on carbon-copy paper (you younger peeps don’t know what this is), and boom—I was the proud “owner” of an $800 amp that I couldn’t actually afford.

But Here’s the Kick in the Wallet…

It wasn’t until weeks later, when that initial buzz wore off, and reality hit. My girlfriend at the time, who later became my wife of 15years (she was way smarter with money-type things than I was) started breaking it down for me: “Do you even know how much interest you’re paying on this?” She asked?

Spoiler alert: I didn’t.

I had signed up for a financing plan that was like a masterclass in poor decision-making. The amp was $799.99, but with interest and only making minimum payments, I was set to pay hundreds of dollars more by the time it was all said and done. And like so many first-time financing deals, it was sold to me like a magic trick—”only $23 per month” hides a sinister truth.

Let’s Run the Numbers

This isn’t just a tale from my financial past—it’s still happening! It happens every single day to people financing phones, furniture, pointy guitars, laptops, and even burritos. Yeah, don’t get me started. I just recently read over on Hanna’s Substack Newsletter, Your Brain On Money about DoorDash partnering with a “Buy Now, Pay Later” service on their food deliveries. Gross!

Okay, let’s say you buy something that costs $800 using a store credit card or the consumer financing option, which I did. The typical interest rate of 25% (not uncommon for store financing or subprime credit cards). If you make only the minimum payment each month, usually around 3% of the balance or a fixed low amount. Probably something like $25.

Other Stories

Thanks again for following along! Keep those Horns Up, my friend 🤘 🤘 And please share this newsletter with those you think would find value!